John Warrillow – Built to Sell Online Course: 8 Things That Drive the Value of Your Company

Archive : John Warrillow – Built to Sell Online Course: 8 Things That Drive the Value of Your Company

BUILT TO SELL

BUILT TO SELL

8 Things That Drive the Value of Your Company

“What is the

Built to Sell

online course?”

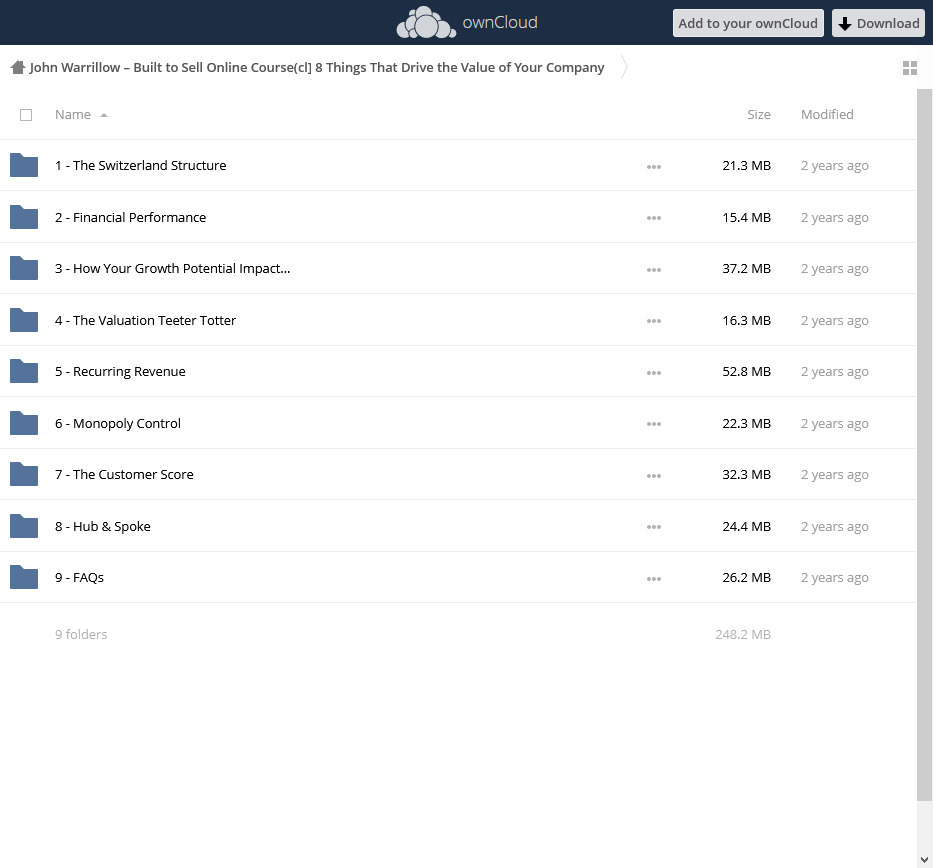

Built to Sell: 8 Things that Drive the Value of Your Company is an interactive, video-based training program that teaches eight strategies for driving up the value of a company to entrepreneurs who want to maximize the value of their business.

Whether you want to sell your business—or just know that you could—you’ll learn the eight things that drive the value of your company and you’ll get an eight-part action plan for dramatically increasing the value of your business.

The training is made up of 32, easy-to-follow videos, done-for-you templates, quizzes and work sheets. All of the training is online using our secure online learning platform. You can view the training videos, connect with others, and compare notes with classmates in the discussion area of each module.

“Who teaches the course?”

John Warrillow, the bestselling author of Built to Sell: Creating A Business That Can Thrive Without You, will be your personal instructor throughout the course. The course includes John’s 32 unique videos, and he personally dedicates one hour each week to answer students’ specific questions during the course discussion forum.

“But I already know what companies in my industry are worth—so why would I still need to take the course?”

If you’re like a lot of entrepreneurs, you use your Profit & Loss (P&L) statement as your report card at the end of the year. You may even use your P&L to figure out what your company is worth by applying a multiple to your profit. But having worked with more than 17,000 entrepreneurs using The Value Builder SystemTM, we’ve seen examples of companies that fetch up to three times more than the average price for companies in their industry.

Likewise, we’ve seen cases where companies are worth less than half the average multiple of their peer group.

“Why would one company be worth two or three times more than a similar company in the same industry?”

The secret to getting a premium over your industry’s standard multiple is to be able to look at your business through the lens of a buyer. Having analyzed the acquisition offers received by more than 17,000 businesses, we have discovered that there are eight factors that impact your company’s value in the eyes of an acquirer more than which industry you are in.

During this course you’ll learn how to:

- Increase your score on each of the eight drivers acquirers care about most.

- Maximize your company’s overall value.

- Find strategic buyers for your business.

- Structure your business like Jason Fried re-positioned Basecamp to maximize its value.

- Accelerate the pace of positive word-of-mouth for your business, using the same technique as companies like Eventbrite, Intuit, Google and Apple.

- Boost your company’s cash flow in the same way Harley Davidson finances its business.

- Differentiate your business using the same methodology Warren Buffet looks for in the companies in which he invests.

- Minimize your company’s reliance on your personal involvement using some of the strategies Tim Ferriss used to reduce the time he spent in his business to just four hours a week.

“Is this a scam?”

No. The foundation of this course is a quantitative analysis of the 17,000 business owners who use The Value Builder SystemTM. The first step every entrepreneur takes when they start working with us is to get their Value Builder Score. We have analyzed more than 17,000 unique business- es and we’ve identified eight factors that contribute to getting higher than average offers.

To give you an idea of how much these eight factors impact the value of your company, let’s take a look at the numbers. The average Value Builder Score is 60 out of a possible 100.

And the average offer our users have received to buy their business is 3.8 times pre-tax profit.

But when we isolate the cohort of our users who achieved a Value Builder Score of 80 or above, the average offer is 6.3 times pre-tax profit—almost double that of the normal user.

“What will be my return on investment?”

Let’s imagine you have a business generating $200,000 in pre-tax profit with an average Value Builder Score (60 out of 100). Based on the statistics, we would expect your business to be worth around $710,000 ($200,000 x 3.55).

Now let’s imagine you take the Built to Sell online course, take action on the recommendations, and improve your Value Builder Score to 80 out of 100. Assuming your business is generating the same $200,000 in profit, we would now expect it to be worth around $1,220,000 ($200,000 x 6.1). You would increase the value of your business by $500,000 without changing your level of profitability.

Reviews

There are no reviews yet.