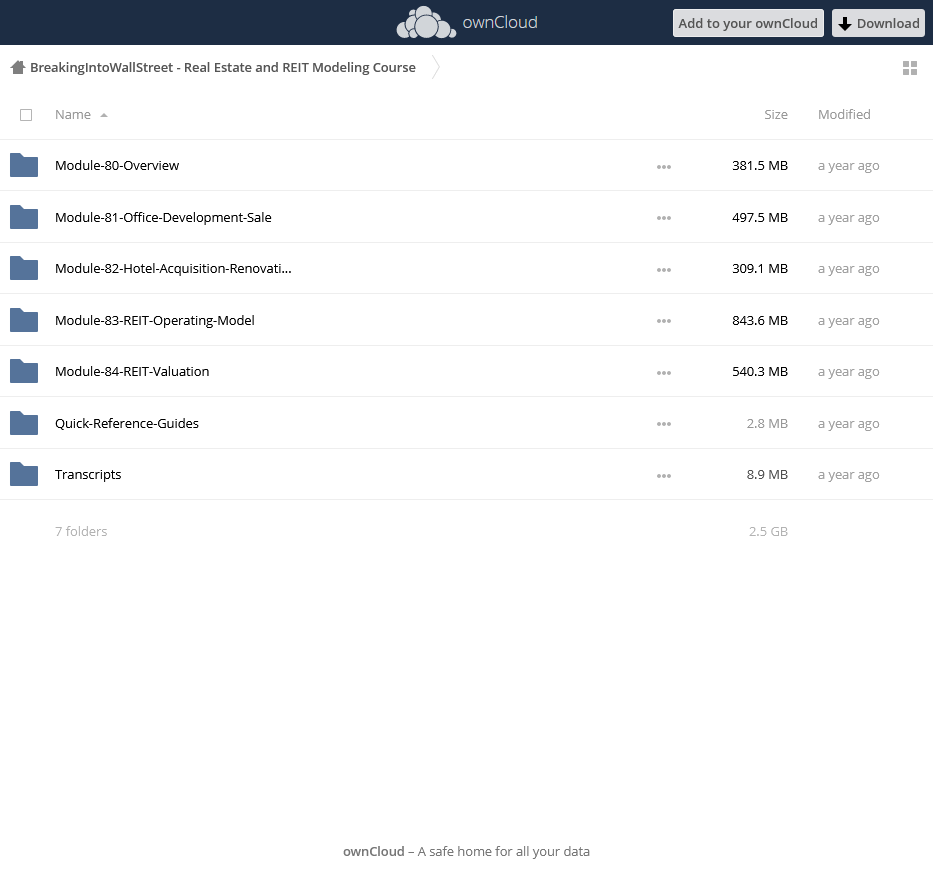

BreakingIntoWallStreet – Real Estate and REIT Modeling Course

Archive : BreakingIntoWallStreet – Real Estate and REIT Modeling Course

Normally, our financial modeling & valuation courses are always prefaced with a caveat: “applies to run-rate, going concern entities, not distressed or restructuring” companies. Why? It’s simple – the rules of engagement are completely different for distressed entities that have financial or operational difficulties. Our distressed series will teach you how to model and value distressed companies and securities undergoing restructuring or the bankruptcy process.

Normally, our financial modeling & valuation courses are always prefaced with a caveat: “applies to run-rate, going concern entities, not distressed or restructuring” companies. Why? It’s simple – the rules of engagement are completely different for distressed entities that have financial or operational difficulties. Our distressed series will teach you how to model and value distressed companies and securities undergoing restructuring or the bankruptcy process.

Distressed Investing Overview

Learn how to analyze and value distressed companies and securities undergoing restructuring or bankruptcy process. First, appreciate and understand the historical perspective and context of the distressed market. Then, explore various opportunities in distressed investing from securities types to investment strategies. Properly identify and isolate the true sources and drivers of returns from supply & demand to operational changes to market rebound to recapitalizations. Quantify and comprehend the dramatic changes to a distressed firm’s capital structure and the implications on the valuation process and realignment of economics. Understand the reorganization and bankruptcy process, including DIP (debtor-in-possession) financing, Section 363 sales (stalking horse), Chapter 11 reorganization, and Chapter 7 liquidation. Fully comprehend the key critical covenants required involved in distressed securities as well as the entire turnaround & restructuring process by identifying key parameters for successful business plan implementation.

Understand distressed investing, different investment strategies & valuation and bankruptcy process

Comprehend capital structure pre- and post-petition, significant of identifying fulcrum security

Comprehend the complexities and nuances involved with distressed analysis

Distressed Financial Modeling

Learn how to model and value distressed companies and securities undergoing restructuring or bankruptcy process. Build upon our Distressed Investing Overview course by quantifying the dramatic changes to a distressed firm’s capital structure and the implications on the valuation process and realignment of economics. Build robust distressed sensitivity financial model. Learning objectives include: model out sample distressed company on a standalone basis, with and without restructuring; incorporate detailed valuation sensitivity to identify key value drivers in a distressed situation; analyze the fulcrum security based on various valuation and leverage scenarios.

Distressed Financial Modeling

Summarize pre-petition capital structure of distressed situation & determine normalized valuation

Construct standalone Income Statement project of distressed company

Layer on various restructuring and turnaround scenarios

Evaluate & analyze decision to restructure and understand financial implications on valuation

Construct super-dynamic and flexible model to automate new vs. old cash flow capital structure

Distressed Financial Modeling & Sensitivity Analysis:

Construct robust sensitivity analysis to determine ultimate recovery to capital structure classes

Sensitize distressed model based on leverage, valuation, new pro forma capital structure

Analyze what constitutes a “bad” deal and its implications for the distressed investor

Understand and appreciate various financial stakeholders and inherent conflicts of interest

Quantify and evaluate the importance of determining the right fulcrum security

Reviews

There are no reviews yet.